Ultimate Guide to Understanding OCO Order

Table of Interests

Looking for Best article on OCO Order, then “Ultimate Guide to Understanding OCO Order”, is for you.

An OCO, or “One Cancels the Other” order allows you to place two orders at the same time. It combines a limit order, with a stop-limit order, but only one of the two can be executed.

In other words, as soon as one of the orders get partially or fully filled, the remaining one will be canceled automatically. Note that canceling one of the orders will also cancel the other one.

When trading on the Binance Exchange, you can use OCO orders as a basic form of trade automation. This feature gives you the option of placing two limit orders simultaneously, which may come handy for taking profit and minimizing potential losses.

How to use OCO orders?

After logging in to your Binance account, go to the Basic Exchange interface and find the trading area as illustrated below. Click on “Stop-limit order” to open a dropdown menu and select “OCO.”

On Binance, OCO orders can be placed as a pair of buying or selling orders. You can find more information about OCO orders by clicking on the question mark.

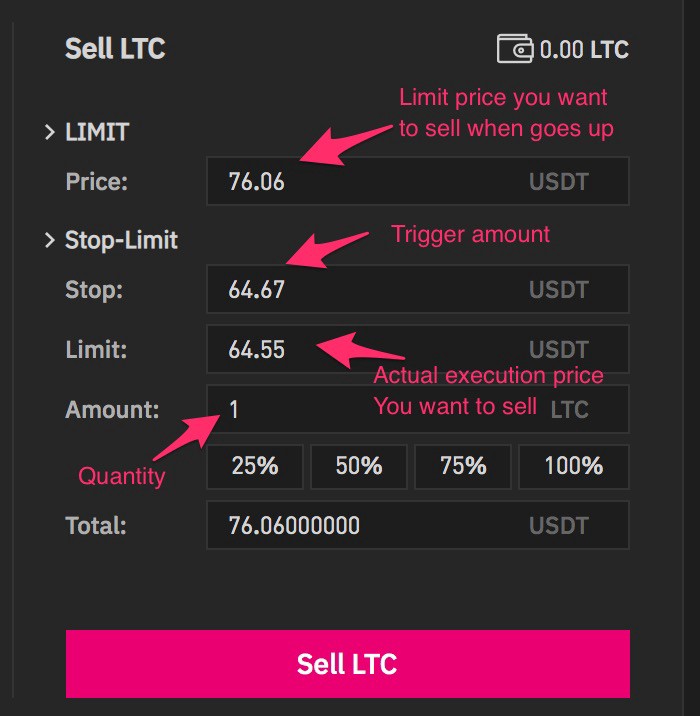

After selecting the OCO option, a new trading interface will be loaded, as shown below. This interface allows you to set a limit and a stop-limit order simultaneously.

Limit order

Price: The price of your limit order. This order will be visible on the order book.

Stop-Limit

- Stop: The price at which your stop-limit order will be triggered (e.g., 0.0024950 BTC).

Limit: The actual price of your limit order after the stop is triggered (e.g., 0.0024900 BTC). - Amount: The size of your order (e.g., 5 BNB).

- Total: The total value of your order.

After placing your OCO order, you can scroll down to visualize the details of both orders on the “Open Orders” section.

As an example, let’s suppose that you just bought 5 BNB at 0.0026837 BTC because you believe the price is close to a major support zone and will presumably go up.

In this case, you can use the OCO feature to place a profit-taking order at 0.0030 BTC along with a stop-limit order at 0.0024900 BTC.

If your prediction is correct and price rises to or above 0.0030 BTC, your sell order will be executed, and the stop-limit order will be automatically canceled.

On the other hand, if you end up being wrong and the price drops to 0.0024950 BTC, your stop-limit order would be triggered. This would potentially minimize your losses, in case the price drops even more.

Note that in this example, the Stop Price is 0.0024950 (trigger price) and the Limit Price is 0.0024900 (the trading price of your order). This means that your stop-limit order would be triggered at the moment the 0.0024950 mark is reached. But, the actual trading price of your order would be 0.0024900. Put in another way, if BNB/BTC drops to or below 0.0024950, a limit sell order at 0.0024900 will be placed.

The OCO feature is a simple but powerful tool, which allows you and other Binance users to trade in a more secure and versatile way. This special type of order can be useful for locking profits, limiting risks, and even for entering and exiting positions. Still, it’s important to have a good understanding of limit and stop-limit orders before using OCO orders.

That’s the much we can take on the topic “Ultimate Guide to Understanding OCO Order “.

Thanks For Reading

Common Cryptocurrency Scams on Mobile Devices

Ultimate Guide to Symmetric versus Asymmetric Encryption

How Blockchain Is Used in The Internet of Things (IoT)

Ultimate Guide to Understanding What Makes a Blockchain Secure

Upto Date Blockchain Use Cases

Initial Coin Offering List – Comprehensive List of Projects Currently Doing ICO

Ultimate Guide to Initial Coin Offering (ICO)

Ultimate Guide to Understanding What Fractional Reserve is

Understanding Why Public WiFi Is Insecure

The Ultimate History of Cryptography

Understanding what DoS Attack is

Ultimate Guide to what Fiat Currency is

Ultimate Guide to zk-SNARKs and zk-STARKs

Things to Avoid When Using Binance Chain

How Blockchain Is Used In Charity

How Blockchain is Used in Supply Chain

Ultimate Guide to What a Replay Attack is

Ultimate Guide to Delegated Proof of Stake

Ultimate Guide to what Ransomware is

Ultimate Guide to understanding Cryptojacking

Ultimate Guide to Understanding Inflation for Beginners

How to Know Cryptocurrencies Pyramid and Ponzi Schemes

Ultimate Beginner’s Guide to Bitcoin’s Lightning Network

Advantages and Disadvantages Of Blockchain

Ultimate Guide to Ethereum Plasma

Leave a Reply