Ultimate Guide Different Order Types

Table of Interests

Looking into order types?, then “Ultimate Guide Different Order Types”, is for you.

When you’re trading stocks or cryptocurrency, you interact with the market by placing orders:

A market order is an instruction to buy or sell immediately (at the market’s current price).

A limit order is an instruction to wait until the price hits a limit before being executed.

That’s orders in a nutshell. Of course, each of these two categories has different variations that do different things, depending on how you want to trade. Curious? Read on.

Introduction

Signed up for an exchange, and wondering what all the different buttons do? Maybe you’ve finished your rewatch of Wall Street, and you’re trying to better understand how stock markets work?

In the following article, we’ll dissect orders: the instructions you send to an exchange to buy and sell assets. As we’ll see shortly, there are two main types: limit orders and market orders. However, these are merely qualities used to describe an assortment of commands.

Let’s get into it.

Market order vs. limit orders

Market orders are orders that you would expect to execute immediately. Essentially, they say at the current price, do x. Suppose you’re on Binance, you want to buy 3 BTC, and Bitcoin is trading at $15,000. You’re happy paying $45,000 for the coins and don’t want to wait for prices to drop lower, so you place a buy market order.

Who’s selling the coins, you ask? We need to look at the order book to figure that out. This is where the exchange keeps a big list of limit orders, which are simply orders that aren’t executed immediately. These might say something like at y price, do x.

For the sake of this example, another user might have placed an order earlier telling the exchange to sell 3 BTC when the price hits $15,000. So, when you place your market order, the exchange matches it with the book’s limit order.

Effectively, you haven’t created an order – instead, you’ve filled an existing one, removing it from the order book. This makes you a taker because you’ve taken some of the exchange’s liquidity away. The other user, however, is a maker because they’ve added to it. Typically, you enjoy lower fees as a maker, because you’re providing a benefit to the exchange.

What you need to know about market orders

The basic kinds of market orders are buy and sell ones. You instruct the exchange to make a transaction at the best available price. Note that the best available price isn’t always the current value displayed – it depends on the order book, so you could end up executing your trade at a slightly different rate.

Market orders are good for instant (or near-instant) transactions. That’s about it, though. Fees incurred from slippage and the exchange mean that the same trade would have been cheaper if done with a limit order.

Common types of orders

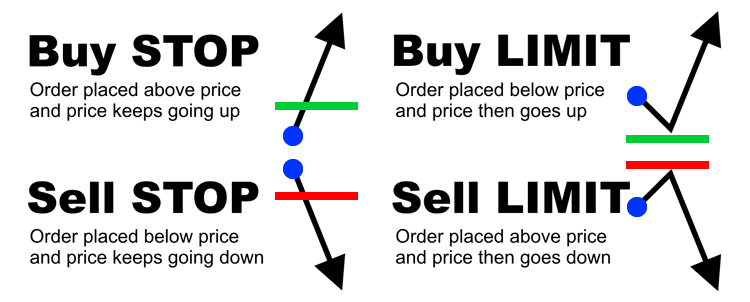

The simplest orders are buy market orders, sell market orders, buy limit orders, and sell limit orders. If you stuck solely to these, though, you’d find yourself with a somewhat restricted trading experience. Instead, you can build on top of these to take advantage of market conditions, whether in short-term or long-term setups.

Stop-loss orders

A stop-loss is a type of market order that involves you setting an off-book instruction to sell at a specific price. As the name might indicate, it’s designed to protect you from any significant losses. Ostensibly, this appears to be a limit order, since you set a price at which to sell instead of executing at market price. However, the order isn’t added to the order book. The trading platform only converts it into a market order when the trigger price is hit.

Stop-limit orders

Stop-limit orders are other good tools for limiting the losses you can incur on a trade. They’re a bit like the stop-loss orders we mentioned in the previous section, but they incorporate an extra step. If BTC was trading at $10,000 and you set up a sell stop-loss order at $9,990, you ensure that you’ll sell your holdings when the price dips by $10.

However, you may not get the exact price you want. A stop-limit combines the best of both worlds to guarantee that you will. Taking our example of $10,000 BTC from above, you specify two parameters: a stop price and a limit price. Your stop price might be, for instance, $9,985. This tells the exchange to then set up a limit order with the limit price you specify – say, $9,990.

If the price recovers to that level, then you’ll sell your holdings for $9,990 or better. Note, however, that the order is only placed after the stop price is hit. You do still run the risk of the price not recovering, in which case you have no protection if it continues to dip below $9,985.

One-cancels-the-other (OCO) orders

A “one cancels the other” (OCO) order is a sophisticated tool that allows you to combine two conditional orders. As soon as one is triggered, the other is canceled. If we take the BTC at $10,000 example, you could use an OCO order to either buy Bitcoin when the price reaches $9,900 or to sell it when the price rises to $11,000. One of these two will be executed first, meaning that the second one is automatically canceled.

What’s time in force?

Another important concept to understand when talking about orders is time in force. This is a parameter that you specify when opening a trade, dictating the conditions for its expiry.

Good ‘til canceled (GTC)

Good ‘til canceled (GTC) is an instruction stipulating that a trade should be kept open until it’s either executed or manually canceled. Generally, cryptocurrency trading platforms default to this option.

In stock markets, a common alternative is to close the order at the end of the trading day. Because crypto markets operate 24/7, however, GTC is more prevalent.

Immediate or cancel (IOC)

Immediate or cancel (IOC) orders stipulate that any part of the order that isn’t immediately filled must be canceled. Suppose you submit an order to buy 10 BTC at $10,000, but you can only get 5 BTC at that execution price. In that case, you would purchase those 5 BTC, and the rest of the order would be closed.

Fill or kill (FOK)

Fill or kill (FOK) orders are either filled immediately, or they’re killed (canceled). If your order instructed the exchange to buy 10 BTC at $10,000, it wouldn’t partially fill. If the entire order of 10 BTC isn’t immediately available at that price, it will be canceled.

Closing thoughts

Mastering the types of orders is vital to good trading. Whether you want to use stop orders to limit the potential for loss, or OCO orders to plan for different outcomes simultaneously, being aware of the trading tools available to you is essential.

Common Cryptocurrency Scams on Mobile Devices

Ultimate Guide to Symmetric versus Asymmetric Encryption

How Blockchain Is Used in The Internet of Things (IoT)

Ultimate Guide to Understanding What Makes a Blockchain Secure

Upto Date Blockchain Use Cases

Initial Coin Offering List – Comprehensive List of Projects Currently Doing ICO

Ultimate Guide to Initial Coin Offering (ICO)

Ultimate Guide to Understanding What Fractional Reserve is

Understanding Why Public WiFi Is Insecure

The Ultimate History of Cryptography

Understanding what DoS Attack is

Ultimate Guide to what Fiat Currency is

Ultimate Guide to zk-SNARKs and zk-STARKs

Things to Avoid When Using Binance Chain

How Blockchain Is Used In Charity

How Blockchain is Used in Supply Chain

Ultimate Guide to What a Replay Attack is

Ultimate Guide to Delegated Proof of Stake

Ultimate Guide to what Ransomware is

Ultimate Guide to understanding Cryptojacking

Ultimate Guide to Understanding Inflation for Beginners

How to Know Cryptocurrencies Pyramid and Ponzi Schemes

Ultimate Beginner’s Guide to Bitcoin’s Lightning Network

Advantages and Disadvantages Of Blockchain

Ultimate Guide to Ethereum Plasma

Leave a Reply