Ultimate Guide to Arbitrage Trading

Table of Interests

Looking for what arbitrage means?, then “Ultimate Guide to Arbitrage Trading”, is for you

Arbitrage trading is a relatively low-risk trading strategy that takes advantage of price differences across markets. Most of the time, this involves buying and selling the same asset (like Bitcoin) on different exchanges. Since the price of Bitcoin should, in theory, be equal on Binance and on another exchange, any difference between the two is likely an arbitrage opportunity.

This is a very common strategy in the trading world, but it’s mostly been a tool of large financial institutions. With the democratization of financial markets thanks to cryptocurrencies, there might be an opportunity for cryptocurrency traders to take advantage of it, too.

Introduction

What if you could guarantee yourself a profitable trade? What would it look like? You’d have to know before even entering the trade that you were going to make a profit. Anyone who could have that kind of edge would exploit it until they no longer could.

While there’s no such thing as guaranteed profit, arbitrage trading is the closest you’ll get. Traders compete ferociously to get the opportunity to enter these types of trades. For this very reason, profits are generally very slim in arbitrage trading and depend heavily on speed and volume per trade. That’s why most arbitrage trading is done by algorithms developed by high-frequency trading (HFT) firms.

What is arbitrage trading?

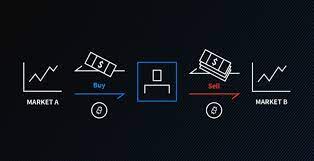

Arbitrage trading is a trading strategy that aims to generate profit by simultaneously buying an asset in a market and selling it in another. This is most commonly done between identical assets traded on different exchanges. The difference in price between these financial instruments should, in theory, be zero since they’re quite literally the same asset.

The challenge an arbitrage trader, or arbitrageur, has is not only finding these pricing differences, but also being able to trade them quickly. Since other arbitrage traders are likely to see this difference in price (the spread) as well, the window of profitability usually closes very fast.

On top of that, since arbitrage trades are generally low-risk, the returns are generally low. That means arbitrage traders not only need to act quickly, but they need a lot of capital to make it worth it.

You might be wondering what types of arbitrage trading is available to cryptocurrency traders. There are certain types to take advantage of, so let’s get right into it.

Types of arbitrage trading

There are many types of arbitrage strategies that traders all over the world in many different markets take advantage of. However, when it comes to cryptocurrency traders, there are some distinct types that are quite commonly used.

Exchange arbitrage

The most common type of arbitrage trading is exchange arbitrage, which is when a trader buys the same cryptoasset in one exchange and sells it in another.

The price of cryptocurrencies can change quickly. If you take a look at the order books for the same asset on different exchanges, you’ll find that the prices are almost never exactly the same at exactly the same time. This is where arbitrage traders come in. They try to exploit these small differences for profit. This, in turn, makes the underlying market more efficient since price stays in a relatively contained range on different trading venues. In this sense, market inefficiencies can mean opportunity.

How does this work in practice? Let’s say there’s a price difference for Bitcoin between Binance and another exchange. If an arbitrage trader sees this, they would want to buy Bitcoin on the exchange with the lower price and sell it on the exchange with the higher price. Of course, the timing and execution would be crucial. Bitcoin is a relatively mature market, and exchange arbitrage opportunities tend to have a very small window of opportunity.

Funding rate arbitrage

Another common type of arbitrage trading for crypto derivatives traders is funding rate arbitrage. This is when a trader buys a cryptocurrency and hedges it’s price movement with a futures contract in the same cryptocurrency that has a funding rate lower than the cost of purchasing the cryptocurrency. The cost, in this case, means any fees that the position may incur.

Let’s say you own some Ethereum. Now you might be happy with that investment, but the price of Ethereum is going to fluctuate a lot. So you decide to hedge your price exposure by selling a futures contract (shorting) for the same value as your Ethereum investment. Let’s say the funding rate for that contract pays you 2%. That would mean you’d get 2% for owning Ethereum without any price risk, resulting in a profitable arbitrage opportunity.

Triangular arbitrage

Another very common type of arbitrage trading in the cryptocurrency world is triangular arbitrage. This type of arbitrage is when a trader notices a price discrepancy between three different cryptocurrencies and exchanges them for one another in a kind of loop.

The idea behind triangular arbitrage comes from trying to take advantage of a cross-currency price difference (like BTC/ETH). For example, you could buy Bitcoin with your BNB, then buy Ethereum with your Bitcoin, and finally buy back BNB with Ethereum. If the relative value between Ethereum and Bitcoin doesn’t match the value each of those currencies has with BNB, an arbitrage opportunity exists.

Risks associated with arbitrage trading

While arbitrage trading is considered relatively low-risk, that doesn’t mean it’s zero. Without risk, there’d be no reward, and arbitrage trading is certainly no exception.

The biggest risk associated with arbitrage trading is execution risk. This happens when the spread between prices closes before you’re able to finalize the trade, resulting in zero or negative returns. This could be due to slippage, slow execution, abnormally high transaction costs, a sudden spike in volatility, etc.

Another major risk when engaging in arbitrage trading is liquidity risk. This happens when there isn’t enough liquidity for you to get in and out of the markets you need to trade to complete your arbitrage. If you’re trading using leveraged instruments, like futures contracts, it’s also possible that you could get hit with a margin call if the trade goes against you. As usual, exercising proper risk management is crucial.

Closing thoughts

Being able to take advantage of arbitrage trading is a great opportunity for cryptocurrency traders. With the right amount of speed and capital to participate in these types of strategies, you could find yourself executing low-risk, profitable trades in no time.

The risk associated with arbitrage trading shouldn’t be overlooked. While arbitrage trading might imply “risk-free profit” or “guaranteed profit”, the reality is there’s enough risk involved to keep any trader on their toes.

Common Cryptocurrency Scams on Mobile Devices

Ultimate Guide to Symmetric versus Asymmetric Encryption

How Blockchain Is Used in The Internet of Things (IoT)

Ultimate Guide to Understanding What Makes a Blockchain Secure

Upto Date Blockchain Use Cases

Initial Coin Offering List – Comprehensive List of Projects Currently Doing ICO

Ultimate Guide to Initial Coin Offering (ICO)

Ultimate Guide to Understanding What Fractional Reserve is

Understanding Why Public WiFi Is Insecure

The Ultimate History of Cryptography

Understanding what DoS Attack is

Ultimate Guide to what Fiat Currency is

Ultimate Guide to zk-SNARKs and zk-STARKs

Things to Avoid When Using Binance Chain

How Blockchain Is Used In Charity

How Blockchain is Used in Supply Chain

Ultimate Guide to What a Replay Attack is

Ultimate Guide to Delegated Proof of Stake

Ultimate Guide to what Ransomware is

Ultimate Guide to understanding Cryptojacking

Ultimate Guide to Understanding Inflation for Beginners

How to Know Cryptocurrencies Pyramid and Ponzi Schemes

Ultimate Beginner’s Guide to Bitcoin’s Lightning Network

Advantages and Disadvantages Of Blockchain

Ultimate Guide to Ethereum Plasma

Leave a Reply