Ultimate Guide to Quantitative Easing (QE)

Table of Interests

Looking for the best article to study on Quantitative Easing, then Ultimate Guide to Quantitative Easing (QE) is for you.

Quantitative Easing (QE) may present different and controversial definitions. But basically speaking, it is a market operation (performed by central banks) that increases liquidity and inflation, with the alleged intention of stimulating the economy of a nation, encouraging businesses and consumers to borrow and spend more.

How does it work?

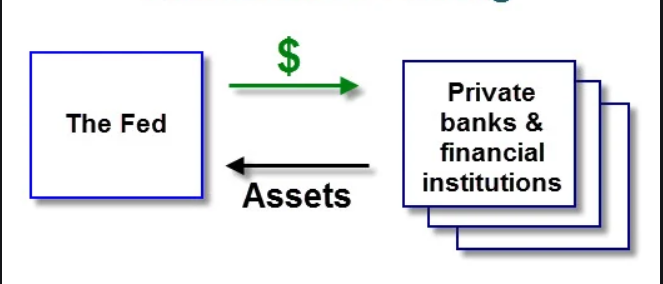

Usually, the operation consists of a central bank injecting money into the economy by purchasing securities (such as stocks, bonds, and treasury assets) from the government or commercial banks.

The central banks add to these member banks’ reserve funds (which are held in compliance with the fractional reserve banking system) through the extension of new credit. Because the new credit is not backed by a commodity or anything of physical value, QE essentially creates money out of nothing.

Therefore, the purpose of QE is to increase the money supply, making it more accessible as a way to stimulate economic activity and growth. The idea is to keep interest rates low, boosting lending for businesses and consumers and promoting confidence in the overall economy. In practice, however, QE doesn’t always work, and it is actually a very controversial approach, with both defenders and detractors.

QE is a relatively new expansive monetary policy. Some scholars believe that its first real-world use was (arguably) in the late 1990s by the Japanese central bank (Bank of Japan). This is arguable because many economists debate whether Japan’s monetary practices at that time truly constituted QE or not. Since then, several other countries have implemented QE practices as an attempt to minimize their economic woes.

What spurred the use of Quantitative Easing?

QE was devised to address problems that arose when conventional modern banking practices failed to prevent a recession. The primary goal of QE is to increase inflation (to avoid deflation) – and interest rate adjustments are one of the main tools that central banks use to keep the inflation rate under control. When borrowing and financial activity slows down, a country’s central bank can lower the rate to make it more affordable for banks to extend loans. In contrast, when things are a bit too free – with spending and credit are approaching risky levels – a higher interest rate may act as somewhat of a stop gate.

Is Quantitative Easing effective?

Shortly after the 2008 financial crisis has ended, the International Monetary Fund (IMF) released a note where QE was discussed as an effective unconventional monetary policy. The analysis included five major central banks: the US Federal Reserve, European Central Bank, Bank of England, Bank of Canada, and the Bank of Japan.

Each institution deployed a unique strategy, but most of them dramatically increased the overall market liquidity. The report claims that the interventions performed by the central banks have been successful and that increased liquidity was important to avoid a prolonged economic crisis and a financial system meltdown.

However, QE is not always effective, and it is highly dependent on context and strategy. Many economies that experimented using QE (or a similar approach) didn’t have the desired effects. If not managed properly, the act of injecting money into the economy and lowering interest rates may cause unexpected and undesirable outcomes. Below we list some of the potential advantages and disadvantages.

Potential advantages and positive effects

- More lending: Because of their increase in funds through the central bank’s purchase of assets, the banks should be encouraged to make more loans.

- Increased borrowing: Consumers and businesses are more likely to take on new debt when interest rates are low.

- Greater spending: Consumers will increase their spending because of all the new lending and borrowing generating more money. With lower interest rates, leaving money sitting in savings is not that appealing.

- Job growth: When businesses have access to more capital through loans and are selling more due to increased consumer spending, they are encouraged to expand and hire more employees.

Potential disadvantages and negative effects

Many specialists express the concern that QE is simply a band-aid for larger, structural problems that will eventually tank the economy. Some potential downsides include:

- Inflation: The increased money supply caused by QE naturally creates inflation. Competition for products will increase because there’s more money circulating, but no increased supply of goods. The higher demand leads to higher prices. If not managed properly, inflation rates can increase fast, leading to hyperinflation.

- No forced lending: In QE, commercial banks are meant to use the money they receive from the central bank to offer more loans. But there is nothing in the process that requires them to do so. For instance, when QE was initially applied in the US after the 2008 financial crisis, many banks held on to their newfound wealth instead of spreading it around.

- More debt: The increased borrowing benefit may lead businesses and consumers to borrow more than they can afford, which can have negative consequences for the economy.

- Impacts other investment instruments: The bond market often responds negatively to instability and abrupt changes, which are quite common after QE policies take place.

Examples

Some countries whose central banks have used Quantitative Easing include:

- Bank of Japan: 2001-2006 and 2012-present (Abenomics).

QE efforts have not eased their financial problems. The Japanese Yen got weaker against the US dollar, and the cost of imports increased. - United States: 2008-2014.

The U.S. implemented three rounds of QE to address the housing crisis and ensuing recession. The economy recovered, but whether it was due to QE is debatable. A comparison to Canada, who didn’t use QE banking practices, reveals no remarkable difference. - European Central Bank: 2015-2018.

The Eurozone has had some hits and misses, with stable inflation, decreased unemployment, and a strong 2017 economy, but it’s still coping with uninspiring wage growth and rising interest rates.

Closing thoughts

As an unconventional monetary strategy, QE may have helped some economies with their recoveries, but it is certainly a controversial strategy, and even that conclusion is debatable. Most of the potential risks, like hyperinflation and excessive debt, haven’t come to fruition in any devastating manner yet, but some countries who have used QE experienced currency instability and a detrimental impact on other economic areas and markets. The long-term consequences are not clear enough, and the effects of QE may be entirely different according to the context.

That’s the much we can take on the topic “Ultimate Guide to Quantitative Easing (QE)”.

Thanks For Reading

O3SCHOOLS TEAM

Common Cryptocurrency Scams on Mobile Devices

Ultimate Guide to Symmetric versus Asymmetric Encryption

How Blockchain Is Used in The Internet of Things (IoT)

Ultimate Guide to Understanding What Makes a Blockchain Secure

Upto Date Blockchain Use Cases

Initial Coin Offering List – Comprehensive List of Projects Currently Doing ICO

Ultimate Guide to Initial Coin Offering (ICO)

Ultimate Guide to Understanding What Fractional Reserve is

Understanding Why Public WiFi Is Insecure

The Ultimate History of Cryptography

Understanding what DoS Attack is

Ultimate Guide to what Fiat Currency is

Ultimate Guide to zk-SNARKs and zk-STARKs

Things to Avoid When Using Binance Chain

How Blockchain Is Used In Charity

How Blockchain is Used in Supply Chain

Ultimate Guide to What a Replay Attack is

Ultimate Guide to Delegated Proof of Stake

Ultimate Guide to what Ransomware is

Ultimate Guide to understanding Cryptojacking

Ultimate Guide to Understanding Inflation for Beginners

How to Know Cryptocurrencies Pyramid and Ponzi Schemes

Ultimate Beginner’s Guide to Bitcoin’s Lightning Network

Advantages and Disadvantages Of Blockchain

Ultimate Guide to Ethereum Plasma

Leave a Reply