Ultimate Guide on How to Calculate Position Size in Trading

Table of Interests

Looking for the best article on Position Size In Trading?, then “Ultimate Guide on How to Calculate Position Size in Trading”, is for you.

No matter how big your portfolio is, you’ll need to exercise proper risk management. Otherwise, you may quickly blow up your account and suffer considerable losses. Weeks or even months of progress can be wiped out by a single poorly managed trade.

A fundamental goal when it comes to trading or investing is to avoid making emotional decisions. As financial risk is involved, emotions will play a huge part. You’ll need to be able to keep them in check so that they don’t affect your trading and investment decisions. This is why it’s useful to come up with sets of rules that you can follow during your investment and trading activities.

Let’s call these rules your trading system. The purpose of this system is to manage risk, but equally importantly, to help eliminate unnecessary decisions. This way, when the time comes, your trading system won’t allow you to make hasty and impulsive decisions.

When you’re establishing these systems, you’ll need to consider a few things. What’s your investment horizon? What’s your risk tolerance? How much capital can you risk? We could think of many others, but in this article, we’ll focus on one specific aspect – how to size your positions for individual trades.

To do that, first, we’ll need to determine how big your trading account is, and how much of it you’re willing to risk on a single trade.

How to determine account size

While this may seem like a simple, even redundant step, it’s a valid consideration. Especially when you’re a beginner, it may help to allocate certain parts of your portfolio to different strategies. This way, you can more accurately track the progress you’re making with different strategies, and also reduce the chance of risking too much.

For example, let’s say you believe in the future of Bitcoin and have a long-term position tucked away on a hardware wallet. It’s probably best not to count that as a part of your trading capital.

In this way, determining the account size is simply looking at the available capital that you can allocate to a particular trading strategy.

How to determine account risk

The second step is determining your account risk. This involves deciding what percentage of your available capital you’re willing to risk on a single trade.

The 2% rule

In the traditional financial world, there’s an investing strategy called the 2% rule. According to this rule, a trader shouldn’t risk more than 2% of their account on a single trade. We’ll go over what that means exactly, but first, let’s adjust it to be more suitable for the volatile cryptocurrency markets.

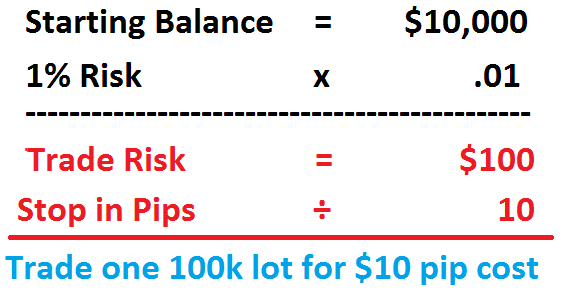

The 2% rule is a strategy suitable for investment styles that typically involve entering only a few, longer-term positions. Also, it’s typically tailored to less volatile instruments than cryptocurrencies. If you’re a more active trader, and especially if you’re starting out, it could be lifesaving to be even more conservative than this. In this case, let’s modify this to be the 1% rule instead.

This rule dictates that you shouldn’t risk more than 1% of your account in a single trade. Does this mean that you only enter trades with 1% of your available capital? Absolutely not! It only means that if your trade idea is wrong, and your stop-loss is hit, you’ll only lose 1% of your account.

How to determine trade risk

So far, we’ve determined our account size and account risk. So, how do we determine the position sizing for a single trade?

We look at where our trade idea is invalidated.

This is a crucial consideration and applies to almost any strategy. When it comes to trading and investing, losses will always be a part of the game. As a matter of fact, they’re a certainty. These are a game of probabilities – not even the best traders are always right. Actually, some traders might be wrong much more than they are right and still be profitable. How is that possible? It all comes down to proper risk management, having a trading strategy, and sticking to it.

As such, every trade idea must have an invalidation point. This is where we say: “our initial idea was wrong, and we should get out of this position to mitigate further losses”. On a more practical level, this just means where we place our stop-loss order.

The way to determine this point is entirely based on individual trading strategy and the specific setup. The invalidation point can be based on technical parameters, such as a support or resistance area. It could also be based on indicators, a break in market structure, or something else entirely.

There isn’t a one-size-fits-all approach to determining your stop-loss. You’ll have to decide for yourself what strategy suits your style the best and determine the invalidation point based on that.

How to calculate position size

So, now, we have all the ingredients we need to calculate position size. Let’s say we have a $5000 account. We’ve established that we’re not risking more than 1% on a single trade. This means that we can’t lose more than $50 on a single trade.

Let’s say we’ve done our analysis of the market and have determined that our trade idea is invalidated 5% from our initial entry. In effect, when the market goes against us by 5%, we exit the trade and take the $50 loss. In other words, 5% of our position should be 1% of our account.

- Account size – $5000

- Account risk – 1%

- Invalidation point (distance to stop-loss) – 5%

The formula to calculate position size is as follows:

position size = account size x account risk / invalidation pointposition size = $5000 x 0.01 / 0.05$1000 = $5000 x 0.01 / 0.05The position size for this trade will be $1000. By following this strategy and exiting at the invalidation point, you may mitigate a much larger potential loss. To properly exercise this model, you’ll also need to take into account the fees you’re going to pay. Also, you should think about potential slippage, especially if you’re trading a lower liquidity instrument.

To illustrate how this works, let’s increase our invalidation point to 10%, with everything else being the same.

position size = $5000 x 0.01 / 0.1$500 = $5000 x 0.01 / 0.1Our stop-loss is now twice the distance from our initial entry. So, if we want to risk the same $ amount of our account, the position size we can take is cut in half.

Closing thoughts

Calculating position sizing isn’t based on some arbitrary strategy. It involves determining account risk and looking at where the trade idea is invalidated before entering a trade.

An equally important aspect of this strategy is execution. Once you’ve determined the position size and the invalidation point, you shouldn’t overwrite them once the trade is live.

The best way to learn risk management principles like this is through practice

That’s the much we can take on the topic “Ultimate Guide on How to Calculate Position Size in Trading“.

Thanks For Reading

Common Cryptocurrency Scams on Mobile Devices

Ultimate Guide to Symmetric versus Asymmetric Encryption

How Blockchain Is Used in The Internet of Things (IoT)

Ultimate Guide to Understanding What Makes a Blockchain Secure

Upto Date Blockchain Use Cases

Initial Coin Offering List – Comprehensive List of Projects Currently Doing ICO

Ultimate Guide to Initial Coin Offering (ICO)

Ultimate Guide to Understanding What Fractional Reserve is

Understanding Why Public WiFi Is Insecure

The Ultimate History of Cryptography

Understanding what DoS Attack is

Ultimate Guide to what Fiat Currency is

Ultimate Guide to zk-SNARKs and zk-STARKs

Things to Avoid When Using Binance Chain

How Blockchain Is Used In Charity

How Blockchain is Used in Supply Chain

Ultimate Guide to What a Replay Attack is

Ultimate Guide to Delegated Proof of Stake

Ultimate Guide to what Ransomware is

Ultimate Guide to understanding Cryptojacking

Ultimate Guide to Understanding Inflation for Beginners

How to Know Cryptocurrencies Pyramid and Ponzi Schemes

Ultimate Beginner’s Guide to Bitcoin’s Lightning Network

Advantages and Disadvantages Of Blockchain

Ultimate Guide to Ethereum Plasma

Leave a Reply